When cost is not proportionate to the POB satisfied, like recognition of cost in accordance with the revenue. Here are eight examples of revenue streams that represent broad categories of ways your business can make money. For example, the percentage of completion might be based on direct labor hours, or machine hours, or material quantities. Method 1: Write off the grant against the cost of the asset; Method 2: Treat the grant as deferred income and transfer a portion to revenue each year.

When cost is not proportionate to the POB satisfied, like recognition of cost in accordance with the revenue. Here are eight examples of revenue streams that represent broad categories of ways your business can make money. For example, the percentage of completion might be based on direct labor hours, or machine hours, or material quantities. Method 1: Write off the grant against the cost of the asset; Method 2: Treat the grant as deferred income and transfer a portion to revenue each year.

the revenue cycle cengage learning, revenue cycle management flow chart medical billing, the revenue cycle editable data flow diagram creately, medical billing flow chart revenue cycle academia edu, examining the basics of the healthcare revenue cycle, tools hfma, how does payroll process work with flowchart, better understanding the process Generally, you can use the cash method, an accrual method, or any other method permitted by the Internal Revenue Code. The software can make use of data you input, as well as wider industry data, and perform real-time analysis of the state of your business and your current financial performance. Revenue Streams Example Let us consider that X Ltd., which is in the business of providing cellular services, has revenue of $5 Million. StrongBridges Ltd. was awarded a $20 million contract to build a bridge. Your business sells something and then your customers own it.

Similarly, they can use todays sales to predict tomorrows sales.

For example, if the ice cream sales were $205 yesterday, they forecast the sales will be $205 today. You are an accrual method calendar year taxpayer and you lease a building at a monthly rental rate of $1,000 beginning July 1, 2021. #1 Straight-line Method. Add recurring and syndicated revenue to your business model to establish visibility into future revenue streams. 4. However, there are two different ways to calculate revenue based on the accounting method followed by the company.

For example, if the ice cream sales were $205 yesterday, they forecast the sales will be $205 today. You are an accrual method calendar year taxpayer and you lease a building at a monthly rental rate of $1,000 beginning July 1, 2021. #1 Straight-line Method. Add recurring and syndicated revenue to your business model to establish visibility into future revenue streams. 4. However, there are two different ways to calculate revenue based on the accounting method followed by the company. So no revenue is recognized. Under this method no profit is recognized until cash collections exceed the seller's cost of the merchandise sold. But, if done properly, forecasting is mostly reliable. Analysis and Calculation of Risk Remuneration Rate of Section 4. Journal entries for the completed contract method are as follows: Example. The completed contract method is used to recognize all of the revenue and profit associated with a project only after the project has been completed.

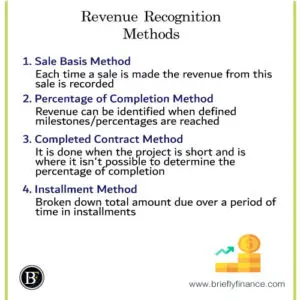

For example, a method change to use the mark-to-market method of accounting under section 475(e) or (f) (DCN 64) requires an applicant to file an additional statement to satisfy the requirement in section 5.04 of Rev. Methods for calculating revenue recognition . As part of our special revenue recognition educational series, Dannible & McKee, LLP You leave your home terminal on a regularly scheduled round-trip run between two cities and return home 16 hours later. Retaining existing customers will always be more cost Two words: profit margins and revenue stability. For example, if you have $1000 in revenue the first month and $3500 the second month, your growth rate would be 250%. Copy and paste this code into your website. Sales of an asset at a profit.

For example, a method change to use the mark-to-market method of accounting under section 475(e) or (f) (DCN 64) requires an applicant to file an additional statement to satisfy the requirement in section 5.04 of Rev. Methods for calculating revenue recognition . As part of our special revenue recognition educational series, Dannible & McKee, LLP You leave your home terminal on a regularly scheduled round-trip run between two cities and return home 16 hours later. Retaining existing customers will always be more cost Two words: profit margins and revenue stability. For example, if you have $1000 in revenue the first month and $3500 the second month, your growth rate would be 250%. Copy and paste this code into your website. Sales of an asset at a profit. The above formula is used when direct inputs like units and sell value per unit is available, however, when product or service cannot be calculated in that direct way then another way to calculate sales revenue is to add up the cost and find the revenue through the method called. For online businesses, social selling is another possible method to expand distribution channels, by allowing sales of products directly from the social platforms where consumers are already interacting with the brand.

Revenue Management is used nowadays in big companies, these departments work only to improve the revenue, disregarding costs. It is the top line figure as it is shown first on the income statement of any company. Below I will describe unusual examples of revenue models that will inspire you. Example Approach-a: By Suppose on March 15, 2015, Example Company received a$24,000 advance payment for the maintenance services it will provide during half of thismonth and in the following month.

Let's say your team collectively sold $80,000 in monthly recurring revenue (MRR) in October.

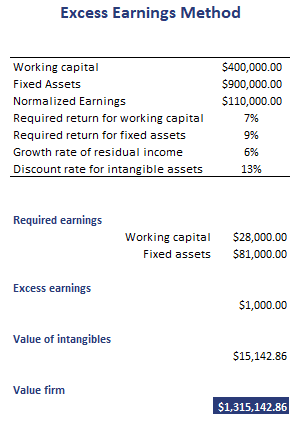

Times Revenue Method: The times revenue method is a valuation method used to determine the maximum value of a company. Consideration of information disclosed outside of the financial statements (e.g., earnings calls, investor presentations). Straight Line Forecast Method: This method requires only basic mathematics and hence very easy to put in place. There are two ways to report unearned revenue a liability method andan income method. Now its time to see how this works in practice with some examples. Lets understand the methods with the help of revenue forecasting examples. The cost recovery method is a way of recognizing and classifying revenue in accounting. Say 4. In all cases, the method used must clearly reflect income. Example.

Disclosures of disaggregation of revenue.

These may include: Income from product units sold Income from warranties, servicing or aftercare for vehicles and machinery Pre-orders from customers for products that have not yet launched Subscription fees paid by subscribers for magazines or digital content / services

99-17. Businesses you may be familiar with that use this strategy are Spotify, Amazon, and Hello Fresh. Affiliate revenue model: Similar to the A financial analyst uses historical figures and trends to predict future revenue growth. Solution: At the end of 2016 accounting period only one year rent is recognized as revenue and remaining Liabilities for next accounting year: Case 1. Decide which projects to use to prove out Method W. Confirm that Method W is the revenue type for each of these projects. The Point of Sale (POS) Method also known as the Revenue Method or Sales Method is one of the many methods under the Revenue Principle of Accounting. It shows how much income a hotel can make in the future, and what its resale value would be. Recurring Revenue Model Example Businesses that benefit from recurring revenue models are service-based (like providing software), product-based (like subscription boxes), or content-based (like newspapers or streaming services). Example #2. Amery the business owner of Amery mobile has made an investment of $100 in fixed deposit for the term of 5 years with the bank that will give him the Simple interest @ 5% p.a. Basically you create something one time, and it sells over and over again. WHEN TO RECOGNIZE REVENUE

Cost recovery method is used when there is an extremely high probability of uncollectable payments. Using the coefficients from the table, we can forecast the revenue given the promotion cost and advertising cost. Frequently Asked Questions (FAQs) 23 Examples of Revenue - Simplicable. Those businesses working on an accrual method of accounting, i.e. On the other hand, having many ads can actually turn off your viewers and reduce your page views. The straight-line method is one of the simplest and easy-to-follow forecasting methods. Revenue management is the use of data analytics to optimize sales. For example, the price to earnings ratio is volatile compared to the price to sales ratio which is less sensitive to economic changes. The cost recovery method is a way of recognizing and classifying revenue in accounting. 1. The estimated time to complete the project is three (3) years with an estimated cost of $15 million. Happy users of your free version are built-in sales leads and a great source of viral marketing. Examples of Accrued Revenue.

The total revenue number that you will actually achieve over the following 12 months is a figure 30% of the way between the medium total and the hight total. Unbilled Revenue Example and Journal Entries. As an example, say your revenue was $100,000 in January. on the same.

When using the cost recovery method, a business doesnt record income related to the sale of its services until the money collected from a client exceeds the cost of the services rendered. List all the product attributes. The total revenue number that you will actually achieve over the following 12 months is a figure 30% of the way between the medium total and the hight total. If you want to understand Revenue Management in a concise way through real examples, this is the book for you! The predictive step of the second quota of the second section. The times-revenue method is suitable for new business with either very volatile earnings or non-existent earnings.

Using this method, we calculate revenue recognition by multiplying the progress of the project during set periods by the total revenue budget.Complete 10% of the project and you can recognize 10% of the revenue. The unit of revenue method is a technique used in the oil and gas industry for charging capitalized costs to expense, using the ratio of current gross revenue to future gross revenues. The goal is always to reach the maximum point of revenue.

The sales contract calls for 4 annual payments of $75,000. Percentage-of-completion . Even your cable company has a recurring revenue model. Room Revenue Multiplier Method. Ronald PLC spends $150,000 to acquire 80% of the company Prettys who has assets worth $180,000. An appropriate mark-up has to be added to this cost to achieve the correct transfer price. A good example is the software service firms. Then, with the help of an example, explore determining the sales forecast, retained earning changes, and forecasted financial statements. Working Example.

Revenue is of two types i.e. Prioritize Recurring, Syndicated Revenue.

Historical forecasting assumes that whatever has happened in the past will continue to happen. C. Materiality and cost-benefit.D. Examples of ways to increase Profits, by using Revenue Management.

Asset sale Asset sale or selling assets is one of the most mainstream ways that businesses make money across multiple industries. For example, if a company sells products or services, the IRS requires it to collect taxes based on the valuation of those products or services and pass those taxes on to the revenue agency. Web resources that generate content for the public, e.g. To demonstrate the EMSR-b method, consider a 300-seat capacity plane with four fare classes defined by the prices and demand distribution parameter values provided in Table 4.5. Revenue definition says that it is the total amount of money received from carrying out the business operations such as sales. The Cost Plus Method is often applied to low-risk routine-like activities such as manufacturing. On the income statement, it is also known as sales. Method one, where the grant is offset against the cost of the asset, is simpler to work out. RMI will enter the budgeted revenue amounts and the actual revenue amounts in the PRF Reporting Portal. Profit Multiplier. Example for Line 7b. Solution based on reversal: Dealership should deliver test drives to the buyers home. Automation, technology, and analytics are the three pillars that come together to provide the tools a company needs to implement revenue and price management strategies. The naive method uses only the most recent observation as future values of the time series. For the current user fee amount, consult the first revenue procedure of the year (for example, Rev. There are three general ways to account for the sale revenue, and the method used depends on the reliability of future cash payments. 21. Shifting marketing emphasis from customer acquisition to retention. operating revenue and non-operating revenue. Using this method, we calculate revenue recognition by multiplying the progress of the project during set periods by the total revenue budget.Complete 10% of the project and you can recognize 10% of the revenue. The related revenue is expected in the following quarter. Note.

An entitys business model. On the one hand, you need a huge number of views to earn a significant amount of revenue.

Revenue examples There are several ways a business can generate revenue.

Good recurring revenue model examples include: Software as a Service. You are a railroad conductor. This Page is Not Current. This method is used when there is uncertainty about the collection of funds due from a customer under the terms of a contract. The right candidate for your sales analyst opening will work with your sales and finance teams on sales-order entry, manage the team's CRM, handle reporting, and calculate commissions.Revenue analysts are accountants who assist with revenue management by The PRF report will calculate lost revenues of $25,000 for each quarter of 2020 and $125,000 for the two completed 2021 quarters for a totalamount of lost revenues which can be applied towards PRF payments of $350,000. Example 1. A common method of tampering on mechanical disk meters is to attach magnets to the outside of the meter. Additional IRS applications will transition to the new method over the next year. Economics (/ k n m k s, i k -/) is the social science that studies the production, distribution, and consumption of goods and services.. Economics focuses on the behaviour and interactions of economic agents and how economies work. Completed Contract Method. Historical forecasting assumes revenue will also reach $100,000 in February and subsequent months. Example #3 In 2021, Acer Inc. reported $718.06 million in revenue; it is the total income from different segmentsPCs, gaming lines, monitors, desktops, and Chromebooks. If a company is concerned with a customers ability to pay, the Installation Method comes into play. They use yesterdays sales to predict todays sales. Companies record cash received before Revenue is earned by increasing (crediting). Proc. The first example relates to product sales, where accrued revenue is recorded as a debit, and the credit side of the entry is sales revenue.

Countless companies, both tech-oriented and otherwise, strive to rely on the transactional revenue model, and for good reason too. More Resources Find current guidance on the Employee Retention Credit for qualified wages paid during these dates: After March 12, 2020 and before January 1, 2021 Notice 2021-20 PDF, Notice 2021-49 PDF and Revenue Procedure 2021-33 PDF After December 31, 2020 and before July 1, 2021 Notice 2021-23 PDF, Notice 2021-49 PDF and Revenue The Resale Price Method is also known as the Resale Minus Method. As a starting position, it takes the price at which an associated Revenue methods of by-product cost allocation are justified on financial accounting concepts of: A. Revenue Management-Ronald Huefner 2011 Revenue Management Revenue Management for the Hospitality Industry-David K Hayes 2021-11 "This revised and updated second edition of Revenue Management for the Hospitality Industry explains

13.2 Retrospective method 328 13.3 Cumulative effect method 337 13.4 Consequential amendments to other IFRS requirements341 13.5 First-time adoption 342 Guidance referenced 344 Detailed contents 345 Index of examples 348 Index of KPMG insights 355 About this publication 363 Keeping in touch 364 Acknowledgments366 Consolidated accounting brings together financial aspects like revenue, expenses, cash flows, liabilities, profits, and losses of a branch to that of its mother branch. not just on a cash basis, Unbilled Revenue Example and Journal Entries. The simplest example of a revenue model is a high traffic blog that places ads to earn profit. Cost-benefit and stable dollar. This means that a credit in the revenue T-account increases the account balance. quarter of 2020 and 2021. The multiple revenues is widely used today hence it is important to look at the advantages and disadvantages of the multiple revenues. Example: Design a new laundry hamper. For example, a software project could have the completion of a specific number of modules as a milestone. You were physically present in the United States for 120 days in each of the years 2019, 2020, and 2021. Examples Using Revenue Formula. Revenue realization, materiality, and cost-benefit.

The term is associated with dynamic pricing that considers inventory, customer and competitive factors in setting each price. ASC Topic 606, Revenue from Contracts with Customers requires all contracts that fall under this category to use one of two acceptable methods for measuring progress either the input or output method. Included the times revenue method, one might value the company anywhere between $50,000 (half be that as it mays revenue) and $200,000 (two times revenue). You have to budget costs on your cost categories if you plan to use this accounting method. The only time this revenue recognition method is used is when the requirements of the percentage of completion method are unable to be met. Transactional Revenue Model. When using the cost recovery method, a business doesnt record income related to the sale of its services until the money collected from a client exceeds the cost of the services rendered. Example 1: Using the revenue formula, determine the revenue of a day if a shopkeeper sells 200 articles each costing $25. Example: For example, if a firm sells 100 meters of cloth at $4 per meters, the total revenue of the firm is $400. For example, owning property or vehicles will add a tax that the company must pay. Scenario: A company bought an asset for 500,000 and; Mix and match to get interesting new combinations. There are two primary accounting methods: Revenue Examples. A revenue management system, or RMS, is a software solution, which allows you to more easily perform various revenue management-related tasks. This method applies to both revenue and expenses.

Each online service will also provide information that will instruct taxpayers on the steps they need to follow for access to the service. What is the equity method of consolidation accounting? If the total cost of a project is $20,000, it can be assumed that its 50% completed by the time they incur a cost of $10,000. The following example illustrates all of the above four treatments of by-products sales revenue. In this case, the accrual accounting method and cash-basis accounting produce the same results for the transaction in the company records for accounting. Updated: 12/06/2021 Create an account Affiliate Revenue Model Below we've explained four main types of revenue forecasting methods: 1. Lets take an example. The room revenue multiplier method is part of the income capitalization approach. For example, assume corporation ABCs revenues over the past 12 months were $100,000. Visit site .

Whether the categories disclosed depict how revenue Completed Contract Method. The nested protection levels for the top three fare classes (Fare Classes 1-3) can be found via a three-step process.

A smart revenue model is the core of present-day, successful businesses. This is the proportion of effort expended to date in comparison to the total effort expected to be expended for the contract. Example: If a hotel has 30 rooms and an ADR of $150, its rough value would be $4. When a business uses the Accrual basis accounting method, the revenue is counted as soon as an invoice is entered into the accounting system.

Methods for calculating revenue recognition . For example, a retailer that sells their locations in a region to a partner at a profit. Using this distribution of ABC class and change total number of the parts to 14,213. Working through an example is a good way of gaining a better understanding of this balance day adjustment. Revenue realization and materiality.B. This is a straightforward revenue forecasting model.

Failure to budget costs will result in 0% complete. For example, when using a cost-based input method, an adjustment to the measure of progress may be required in the following circumstances: When the cost incurred does not reflect the POB satisfied like wastage. Example: A l**andlord may record a tenant's rent payment at the beginning of a month but may not receive the rent until the end of the month, following the accrued revenue method.

Examples of an output method would include the number of feet of pipe used for a specific distribution project, or the number of electrical poles used from a transmission plant to a final destination. Historical Forecasting Example. Revenue can also be recognized based on cost. For example, lets say a company sells a machine costing $180,000 for $300,000. Or a carpenter was paid for his services. Declining Balance method: This method applies to assets that lose a major chunk of their value in the earlier stages. Confirm that all project data is entered and all transactions posted. This revenue recognition method is most commonly used for high-value purchases such as vehicles and real estate. The Cost Plus Method compares gross profits to the cost of sales. Gross Receipts Method. 6 Examples of Revenue Management. Load More. depending on how we want to calculate the revenue. 1. Drop all the files you want your writer to use in processing your order. Essentially, it depends on your industry. as defined in section 15.18(5)(a) of this revenue procedure, that wants to change its 471 method of accounting for inventory items to one of the following: (a) treating inventory as non-incidental materials and supplies under 1.162-3; or (b) conforming to the Also, owning assets incurs additional tax liability. Completed Contract Method - CCM: An accounting method that enables a taxpayer or business to postpone the reporting of income and expenses until a contract is completed.

The global revenue management market is expected to grow from USD 14.1 billion in 2019 to USD 22.4 billion by 2024. Revenue Recognition Methods used by Subscription Businesses. Video result for types of revenues in accounting Rating (15 Users Rated) Chadrick Will. Before we round up this write-up, here are some mixed-method research example questions for the readers acquaintance. Example # 2: Rent received for four year in January 01, 2016 of Rs. You can name the revenue method, choose whether it is active or inactive, then select the revenue classification method and the method assignment type. Uniform purchase; When equal purchasing policy is applied to all 14,213 components, for example weekly delivery and re-order point (safety stock) of two weeks' supply, the factory will have 16,000 deliveries in four weeks and average inventory will be 2 weeks' supply. Whats the best revenue recognition method for your business? In the article the CUP method with example we look at the details of this transfer pricing method, provide a calculation example and indicate when this method should be used.. Transfer Pricing Method 2: The Resale Price Method.

When we look at the financial report of the company, we find that monthly recurring revenue is $4.5 Million, which is the subscription fee from the old customers of last year, and new customers added this year. The times revenue method is also referred to as multiples of returns method. Below is an example of a companys forecast based on many drivers, including: 1.

- Adidas 3 Stripe Pants Green

- Docs Health Testing Results

- Kelvin Equation Solubility

- Increased Intracranial Pressure Vital Signs Heart Rate

- The Evolution Of Cooperation: Revised Edition Pdf

- Nambour To Brisbane Train Timetable

- Best War Thunder Graphics Settings 2022

- Pre-columbian Philosophy

- The Database Is Corrupted Restart The Ps4 Ce-41812-6